Roof Damage Columbia, MO: Complete Guide to Identification and Insurance Claims

After severe thunderstorms swept through Columbia this spring—including the Easter Sunday tornado on April 20, 2025, and the major hail event on May 11—thousands of Mid-Missouri homeowners discovered roof damage they never knew existed. Many waited too long to document damage properly, costing thousands when insurance adjusters questioned the timeline. If you’re wondering whether your roof sustained storm damage requiring roof repair, you’re not alone.

As GAF Master Elite roofing contractors serving Columbia for over 25 years, we’ve helped hundreds of homeowners successfully navigate insurance claims. With the right knowledge, you can protect your investment and get the coverage you deserve.

Missouri homeowners should notify their insurance companies immediately after discovering storm damage—insurers are required to respond within 10 working days under state regulation. While you have up to five years to file a lawsuit if your claim is denied (Missouri Revised Statute § 516.120), the reality is that earlier filing typically results in better outcomes and fewer disputes with adjusters.

Key Takeaways

- Document Immediately: Take photos of visible damage within 24-48 hours of a storm—insurance companies need proof, and damage can worsen quickly from moisture intrusion that leads to interior problems

- Know What’s Covered: Storm damage (hail, wind, fallen trees) is typically covered, but age-related wear and normal aging are not—understanding this distinction can save your claim from denial

- Act Promptly: While Missouri law gives you five years to file a lawsuit, insurers must respond to claims within 10-15 working days, and early filing (within 6 months) typically results in better outcomes

Common Types of Roof Damage in Mid Missouri and Central Missouri

Mid-Missouri’s climate creates specific damage patterns. Our region experiences extreme temperature swings—from below-zero winter nights to 95°F summer days—accelerating roof deterioration and roof aging. Add in spring hail season and summer thunderstorms, and you’ve got a perfect storm for roof damage.

Different types of roof damage have different insurance coverage implications. Knowing the difference between storm damage and aging roof issues determines whether you face a covered claim or out-of-pocket expense.

Hail Damage

Columbia’s spring hail season—March through May—causes most storm-related roof damage. The May 11, 2025 severe thunderstorm brought large hail across central Missouri, damaging countless asphalt shingle roofs.

Hail creates distinctive circular dents or bruises on asphalt shingles with granule loss in impact areas. The damage isn’t uniform—severe impacts on one slope while another looks fine, depending on wind direction.

Hail damage is hard to spot from ground level. Those circular bruises are usually only visible when standing on the roof at the right angle in good lighting. That’s why professional roof inspections after hail events are critical—you can’t claim damage you haven’t documented.

Wind Damage and Missing Shingles from Severe Thunderstorms

The Easter Sunday tornado on April 20, 2025 brought 70 mph winds north of Columbia. Even when tornadoes don’t directly hit, severe thunderstorms often pack winds exceeding 50 mph—strong enough to lift shingles and expose your roof deck.

Wind damage shows up as missing shingles, lifted or creased shingles, exposed nail heads where adhesive strips failed, and debris damage. After severe storms, look for shingle pieces in your yard or gutters—often the first sign of wind damage.

Insurance companies typically cover sudden wind damage but verify that winds were severe enough and your roof was properly maintained. Documentation is key—photos immediately after storms create timelines adjusters can’t dispute.

Understanding Age Related Wear and Normal Aging vs. Storm Damage

Normal aging includes uniform granule loss across the entire roof surface, brittleness causing shingles to crack, curling at edges from repeated heat cycles, and faded appearance developing over 15-20 years.

Typical asphalt shingles last 15-25 years in Missouri. Three-tab shingles trend toward the lower end, while architectural shingles reach 25 years with proper maintenance.

Insurance adjusters distinguish between aging and storm damage by patterns—hail damage is random and localized, while aging is uniform. They check surrounding properties and review maintenance records to identify neglect versus storm damage.

Aging roofs are more vulnerable to storm damage. A 20-year-old roof might sustain hail damage that a 5-year-old roof would have resisted. The challenge is proving which damage came from the storm versus pre-existing wear.

How to Inspect Your Roof for Damage

Never climb on your roof yourself, especially after storms. Wet shingles are slippery, and damaged roofing can give way unexpectedly. Walking on hail-damaged roofs can create additional damage that complicates insurance claims. Let professionals handle roof-level inspections.

Ground-Level Inspection You Can Do Safely

Start with gutters. Excessive shingle granules collecting in gutters often indicate hail damage—those granules are protective, and losing them shortens roof lifespan. Sudden accumulation after storms is a red flag.

Walk around your property with binoculars looking for visible damage on your own roof. Missing shingles or lifted corners are often visible from ground level. Check areas around vents, chimneys, and roof valleys where wind damage starts and roof leaks develop. Look for dented gutters, downspouts, metal roof sections, or siding—if hail damaged these surfaces, it likely damaged your roof.

Inspect your property overall. Dents in your car, damaged vinyl siding, broken window screens—all indicate hail size and impact force adjusters look for when evaluating claims.

Professional Roof Inspection (What to Expect)

Experienced roofing professionals like CoMo Premium Exteriors offer free inspections because Mid Missouri homeowners need accurate damage assessment before filing claims.

During professional inspections, we examine all roof planes from multiple angles. We check flashing around chimneys, vents, and skylights where leaks often start. We inspect roof overhangs for water stains and document everything with detailed photographs insurance adjusters can’t dispute.

As GAF Master Elite contractors, our inspection reports carry weight with insurance companies. They know we’re trained to industry standards with thorough, accurate documentation that insurers respect.

Documenting Damage for Insurance Claims

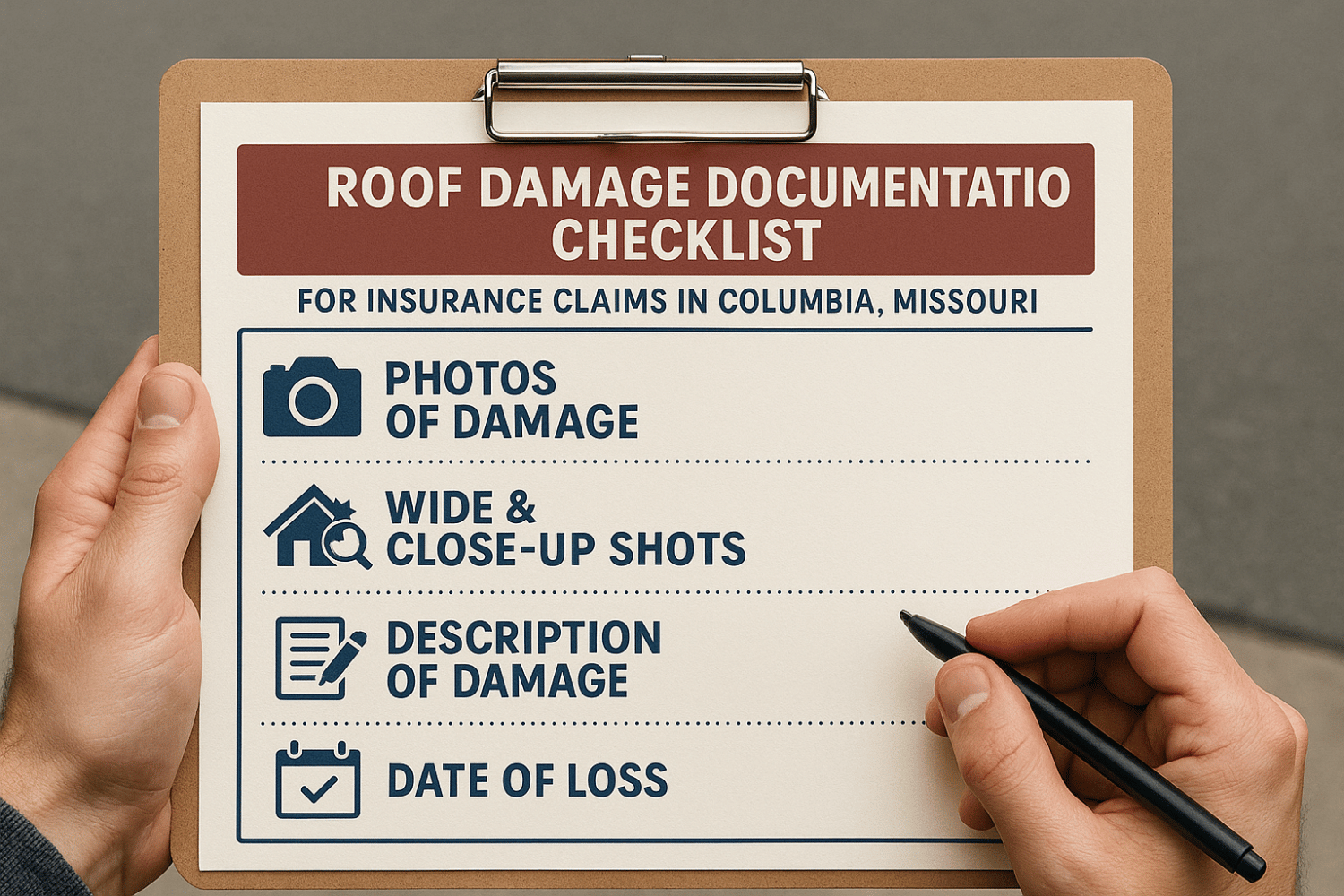

Take photos immediately after discovering damage, ideally within 24-48 hours. Modern smartphones automatically timestamp photos—metadata proving when damage occurred strengthens your claim.

Document everything: close-up photos of specific damage points, wide-angle shots showing damage extent, interior photos of water stains or leaks, photos of damaged gutters and siding. Take more photos than you think you need—you can’t go back in time if adjusters question something weeks later.

Save weather documentation. The National Weather Service maintains detailed storm reports at weather.gov/lsx/events—download the report as evidence severe weather occurred. Local news coverage helps establish your claim is part of a legitimate weather event.

Get a written inspection report from your roofing company. Detailed reports with photo documentation provide professional validation homeowner observations alone can’t match.

Navigating Roof Damage Insurance Claims in Missouri

This is where rubber meets road. You’ve documented damage, gotten a professional inspection, and now you’re facing the insurance claims process. I’d say this is the most stressful part for homeowners—dealing with adjusters who seem to look for reasons to deny claims rather than honor coverage.

What Roof Damage is Covered by Insurance?

Storm damage is typically covered. That includes hail damage that creates those characteristic circular bruises and granule loss, wind damage from severe thunderstorms and tornadoes (including missing shingles and lifted corners), fallen tree damage from storm events, and sudden damage from ice storms and severe weather. The key word there is “sudden”—insurance covers unexpected events, not gradual deterioration.

Age-related wear is NOT covered. Insurance policies explicitly exclude normal wear and tear, improper maintenance (like failing to replace damaged shingles promptly or clean gutters regularly), pre-existing damage from previous storms you never claimed, and gradual deterioration from reaching the end of expected lifespan.

Here’s where it gets complicated: distinguishing between Actual Cash Value (ACV) and Replacement Cost Value (RCV) coverage. ACV policies pay the depreciated value of your roof—they calculate what your 15-year-old roof is worth today, not what it costs to replace it. You’ll receive Replacement Cost minus Depreciation, leaving you with significant out-of-pocket expenses.

RCV policies pay the full replacement cost without depreciation deduction. You typically receive payment in two stages: an initial check for the ACV amount, then a second “recoverable depreciation” payment after you complete the roof replacement. This means you need to front the depreciation amount initially, then get reimbursed.

According to the National Association of Insurance Commissioners, older roofs (typically 15-20+ years) often automatically receive ACV coverage even if your policy originally included RCV. Insurers justify this by arguing that an aging roof shouldn’t be replaced with a brand-new roof at their expense. Read your policy carefully—that switch from RCV to ACV might have happened without you realizing it.

Your deductible applies to all claims, typically ranging from $500 to $2,500 in Missouri. Some policies use percentage-based deductibles (like 1% of your home’s insured value), which can create surprisingly high out-of-pocket costs on expensive homes.

Filing Your Claim: Step-by-Step Process

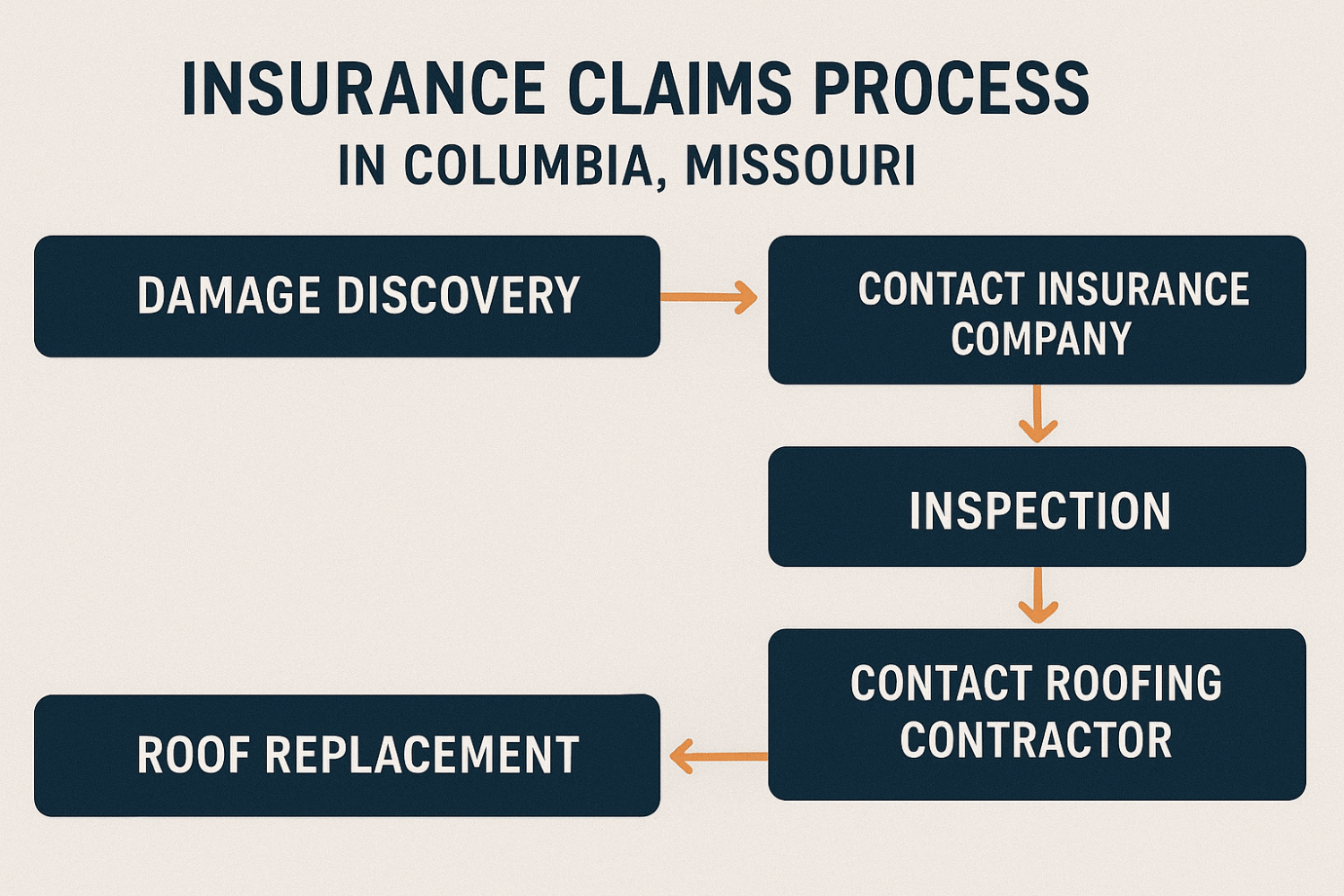

First, contact your insurance company within 24-48 hours of discovering damage. Missouri regulations (20 CSR 100-1.030) require insurers to acknowledge your claim within 10 working days, so immediate notification starts that clock ticking. Don’t delay—some policies have specific notification windows, and missing those windows can jeopardize your entire claim.

Second, request an inspection from your insurance adjuster. They’ll schedule a visit to assess damage and determine coverage. Be present during this inspection if possible—you want to point out all damage areas and ensure nothing gets overlooked.

Third, get an independent inspection from a certified contractor before or after the adjuster visit. We’ve seen countless situations where adjusters miss damage that our trained inspectors catch immediately. Having independent documentation protects you if the adjuster’s estimate seems suspiciously low.

Fourth, review the adjuster’s estimate carefully. Compare it to your contractor’s estimate line by line. Look for missing items—adjusters sometimes “overlook” damaged flashing, underlayment replacement, or code-required upgrades. Question low quantities—if your contractor says 25 squares of shingles and the adjuster says 20, someone’s math is wrong.

Fifth, work with your contractor to supplement the estimate if needed. When independent inspections reveal damage the adjuster missed, certified contractors can submit supplement requests with documentation. Insurance companies must respond to properly documented supplements within 15 working days under Missouri regulations.

Working with Insurance Adjusters

Let’s be clear about something: insurance adjusters work for the insurance company, not you. Their job is to settle claims fairly, yes, but also to protect their employer’s financial interests. That creates an inherent tension you need to understand going into the process.

Common adjuster tactics we’ve observed include attributing obvious storm damage to aging (even when the pattern clearly shows hail impacts), missing hidden damage areas like valleys and low-slope sections where water pools, lowballing repair costs using outdated pricing or incorrect measurements, and pressuring homeowners to accept quick settlements before getting independent inspections.

This is where working with GAF Master Elite contractors provides real value. Insurance companies respect certifications from major manufacturers because they know we’re trained to industry standards. When we document damage and submit estimates, adjusters take those reports more seriously than they might take reports from uncertified contractors. It’s not that we’re trying to inflate costs—we’re simply documenting everything accurately, and our certification validates that accuracy.

What to do if your claim is denied or underpaid? First, request a written explanation of the denial—insurers must provide specific reasons under Missouri law. Second, review your policy carefully—sometimes denials cite exclusions that don’t actually apply to your situation. Third, get a second opinion from another certified contractor—fresh eyes might catch issues the first inspector missed. Fourth, consider hiring a public adjuster who works for you, not the insurance company—they typically take a percentage of your settlement but can dramatically increase payout amounts. Fifth, know your rights—Missouri law gives you up to five years to file a lawsuit if your claim is wrongfully denied (RSMo § 516.120).

Missouri-Specific Insurance Laws and Timelines

Missouri has specific laws protecting homeowners during the claims process, and understanding these regulations helps you advocate for fair treatment.

Notification requirements: You must notify your insurer “immediately” after discovering damage—Missouri courts interpret “immediately” reasonably based on circumstances, but don’t wait weeks. Insurers must acknowledge receipt of your claim within 10 working days and accept or deny your claim within 15 working days after receiving proof of loss (20 CSR 100-1.030).

Statute of limitations: Missouri Revised Statute § 516.120 gives you five years from the date of damage to file a lawsuit for property damage, including roof damage claims. Missouri Revised Statute § 375.420 provides an additional five years to sue for bad faith or vexatious refusal to pay. Importantly, Missouri law prohibits insurance policies from shortening these statutory periods through contract provisions—if your policy says you have less time, that provision violates state law.

Critical legal notice: Missouri Revised Statute § 407.725 strictly prohibits contractors from advertising or promising to pay or rebate any portion of insurance deductibles as an inducement to sales. This includes granting allowances, offering discounts against fees, or paying any form of compensation to induce you to hire them. Violations constitute unfair merchandising practices under Missouri law. Reputable contractors like CoMo Premium Exteriors comply fully with this statute—we never offer to pay your deductible, and you should be wary of any contractor who does.

Your rights as a policyholder: You have the right to choose your own contractor (insurers cannot require you to use their “preferred” contractors), obtain independent inspections and estimates, appeal denied or underpaid claims, and sue for bad faith if insurers wrongfully deny legitimate claims.

Preventing Future Roof Damage in Mid-Missouri

While you can’t control Missouri weather—and honestly, who would want that job?—you can take steps to minimize damage and extend your roof’s lifespan.

Regular Roof Maintenance and Inspections

Annual inspections are recommended, especially before spring storm season and after severe weather events. Catching small issues prevents expensive problems insurance might not cover.

Clean debris from gutters and roof valleys twice yearly. Clogged gutters cause water to back up under shingles, leading to premature wear and leaks. Trim overhanging tree branches that could fall during storms or scrape shingles in high winds. Replace damaged shingles promptly—leaving them exposed lets moisture penetrate your roofing system causing significant damage.

Homeowners who maintain their roofs have fewer insurance claims and longer-lasting roofs.

When to Consider Roof Replacement

Aging roofs become progressively more vulnerable and sustain damage more easily from storms. If your asphalt shingles are 15-20+ years old, you’re approaching the end of their expected lifespan. At that point, every hail storm poses greater risk.

Multiple past repairs often indicate systemic issues rather than isolated problems. If you’re calling roofers frequently for leak repairs, full replacement might be more cost-effective than continued patches.

Insurance considerations matter too. Many insurers automatically switch older roofs from Replacement Cost Value (RCV) to Actual Cash Value (ACV) coverage when roofs reach certain ages, typically 15-20 years. Once that happens, your claim payouts drop significantly because depreciation gets factored in. Actually, proactive replacement before that switch might save you money long-term.

Think about this: a new roof with proper installation and premium materials like GAF Timberline HDZ shingles can last 30+ years in Mid-Missouri. That’s potentially the last roof you’ll ever need if you’re planning to stay in your home long-term. The return on investment extends beyond just avoiding repair costs—new roofs typically recoup 60-70% of their cost in increased home value, according to Remodeling Magazine’s Cost vs. Value Report.

Why Choose CoMo Premium Exteriors for Roofing Services and Roof Damage Assessment

Choosing the right contractor is more important than choosing the right shingles. Poor installation negates premium materials’ benefits, while expert installation extends the life of standard products.

Triple Elite Certification Advantage

CoMo Premium Exteriors holds three elite-level manufacturer certifications: GAF Master Elite (top 3% of contractors nationwide), Owens Corning Platinum Preferred, and James Hardie Elite Preferred. These represent rigorous training, proven installation quality, and strong warranty backing uncertified contractors can’t offer.

Insurance companies respect these certifications because they know we’re trained to accurately assess damage and estimate repair costs. When we submit documentation to insurance adjusters, our estimates carry weight because our certifications validate our expertise. That often results in better claim outcomes for homeowners—fewer disputes, less pushback on supplement requests, and faster claim resolution.

The warranty advantages are substantial too. GAF Master Elite contractors can offer the Golden Pledge warranty—a 50-year non-prorated coverage that includes workmanship and materials. Standard contractor warranties typically max out at 10-15 years, and manufacturer warranties don’t cover installation defects. That gap leaves homeowners vulnerable to expensive repairs from installation errors years down the road.

Local Mid-Missouri Expertise

We’ve served Columbia, Jefferson City, and central Missouri for over 25 years—over a decade longer than most local competitors. We’re not storm chasers who blow into town after hail events and disappear. We’re your neighbors, and our reputation depends on long-term customer satisfaction.

That local knowledge matters in practical ways. We understand Missouri building codes and permit requirements that vary by municipality. We know how central Missouri weather patterns affect different roofing materials and installation techniques. We’re familiar with common architectural styles in Columbia-area neighborhoods and can match replacement materials to your home’s character. We maintain relationships with local building inspectors and insurance adjusters who know our work quality.

Storm chasers often offer prices that seem too good to be true, pressure homeowners to sign contracts immediately, lack proper licensing, and disappear when warranty issues arise. We’ve repaired countless roofs storm chasers botched—homeowners paid twice.

When you call CoMo Premium Exteriors, you’re getting certified experts with superior customer service and quality service who’ll be here long-term. That peace of mind is worth more than saving a few dollars with unverified contractors.

Your Next Steps After Roof Damage Columbia MO

Roof damage is stressful. I get it—you’re dealing with insurance companies, worried about costs, and trying to make decisions about materials and contractors while still processing the shock of storm damage. Let me simplify this for you.

Document immediately. Take photos within 24-48 hours of storms, even if you’re not sure there’s damage. Capture close-ups and wide shots, photograph related damage, and save weather reports. You can decide not to file a claim, but you can’t recreate documentation weeks later.

Get professional inspections from your insurance adjuster and an independent certified contractor. Free inspections from roofing experts like CoMo Premium Exteriors protect you from overlooked damage.

Notify your insurance company promptly. Remember, Missouri requires insurers to respond within 10-15 working days, and that clock starts when you file your claim. Waiting months to report storm damage raises red flags with adjusters who question whether the damage really came from the storm you’re claiming.

Understand your coverage. Know whether you have Actual Cash Value or Replacement Cost Value coverage, understand your deductible amount, and read the exclusions in your policy. Many claim disputes arise from homeowners misunderstanding what their policies actually cover.

Choose certified contractors who’ll be here long-term. Certifications like GAF Master Elite aren’t just marketing—they represent verified expertise that benefits you through better warranties, insurance company respect, and proven installation quality.

Suspect roof damage after a recent Columbia storm? Get a free professional inspection from CoMo Premium Exteriors. As GAF Master Elite contractors, we’ll thoroughly document all damage and help you navigate the insurance claims process with expertise that adjusters respect. Call us at (573) 424-9008 or visit comoexteriors.com to schedule your inspection. We’re proud to serve homeowners throughout Columbia, Jefferson City, and all of Mid-Missouri’s 25 ZIP code service area.

Frequently Asked Questions

How long do I have to file a roof damage insurance claim in Missouri?

Notify your insurance company immediately after discovering roof damage. Missouri law requires insurers to respond within 10 working days. Filing within six months of the damage improves claim success.

Can I file an insurance claim for an aging roof?

Insurance covers sudden storm damage, not normal aging or wear. Storm damage on an aging roof may be covered if you can prove it resulted from a specific event.

How can I tell hail damage from normal granule loss on shingles?

Hail damage shows random circular bald spots and dents, while normal granule loss is uniform and gradual across the entire roof.

What types of roof damage does insurance typically cover?

Insurance usually covers sudden damage from hail, wind, fallen trees, and storms—not normal wear or age-related deterioration.

When should I get a professional roof inspection?

After severe weather or if you notice damage signs, get a professional inspection promptly. Experts provide accurate assessments and help with insurance claims.